[[{“value”:”

PHARMANIAGA’s quarter three financial year 2025 (3QFY25) and nine months of financial year 2025 (9MFY25) core earnings for dropped to RM5.2 mil and RM33.9 mil respectively.

“This is due to the higher transportation costs incurred for the delivery of new products recently added to the Approved Products Purchase List (APPL) to East Malaysia, as deliveries were made via air and sea freight,” said MBSB Research.

Meanwhile, 9MFY25 revenue remains on a positive growth to RM3.0 bil.

Likewise, 3QFY25 and 9MFY25 profit after tax (PAT) gained to RM8.2 mil (+96%yoy) and RM36.2 mil (+70%yoy) respectively. This improvement was driven by higher demand from government hospitals for in-house manufactured products.

The long-term outlook for this segment remains positive, supported by ongoing expansion of the vaccine manufacturing business and sustained demand.

Meanwhile, 3QFY25 and 9MFY25 profit after tax dropped to a deficit of -RM5.6 mil and RM0.1 mil respectively. The weak performance was attributed to higher transportation costs incurred in the quarter.

Additionally, the selling of remaining inventories purchased at old prices and subsequently sold at the revised pricing contributed to the weaker profit.

Nevertheless, these impacts were mitigated by volume growth in the concession segment, driven by increased government hospital orders and the addition of new products to the APPL.

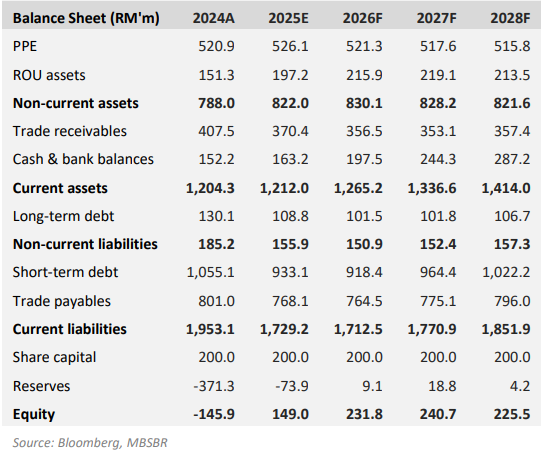

The group’s financial position reflected positive movements stemming from the Regularisation Plan.

Cash and bank balances are higher due to proceeds from the Regularisation Plan earmarked for business expansion (new warehouses, product development of vaccines, insulins, and generic drugs).

Borrowings were recorded lower due to partial repayment using proceeds from the Regularisation Plan, supported by effective inventory management.

Additionally, payables were higher from increased inventory purchases following the addition of new products to the APPL, while receivables were higher with the majority from the government, and full collection expected by the end-year.

“We noted that air freight and sea freight are not inexpensive from shipment from Peninsular Malaysia to East Malaysia, notably for bulk items,” said MBSB.

Air freights are based on the actual weight or volumetric weight of the item/container and can cost over RM35/kg for heavy weights, with higher initial fees. Sea freights can cost at a range of RM60- 90 per 0.1 cbm, and the final total cost will be dependable on the final port and backhaul cost.

In general, the movement of goods to East Malaysia is an international-level logistics operation in terms of cost and complexity, making it more expensive than Peninsular Road logistics, which is cheaper and faster.

Additionally, the higher transportation costs cited were specifically for new products, which may be urgent, given that the group was in need to use air freights in such a short time.

Hence, MBSB maintains their Buy call for Pharmaniaga. However, they remain vigilant on the risk of repeated cost, if APPL expansion in East Malaysia continues until end-year.

Also, if transition cost of logistics upgrades continues. This revision is pending further clarity from the group in the upcoming briefing. —Nov 14, 2025

Main image: Pharmaniaga

The post Transportation expenses weigh on Pharmaniaga’s profitability: MBSB first appeared on Focus Malaysia.

“}]]